When the Brewers Association released the results of their Brewery Operations Benchmarking Survey last year, the data confirmed that there’s still work to do when it comes to diversifying the …

Read More

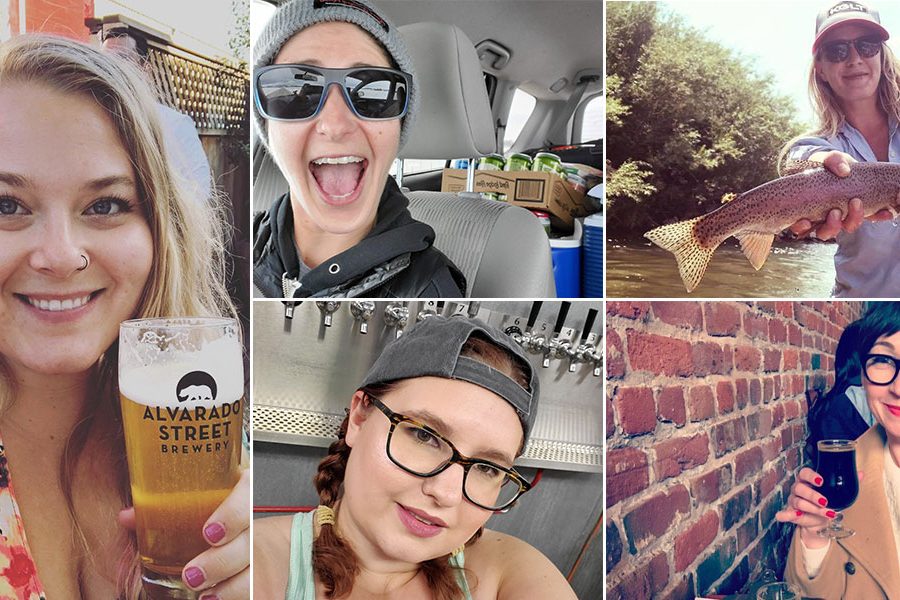

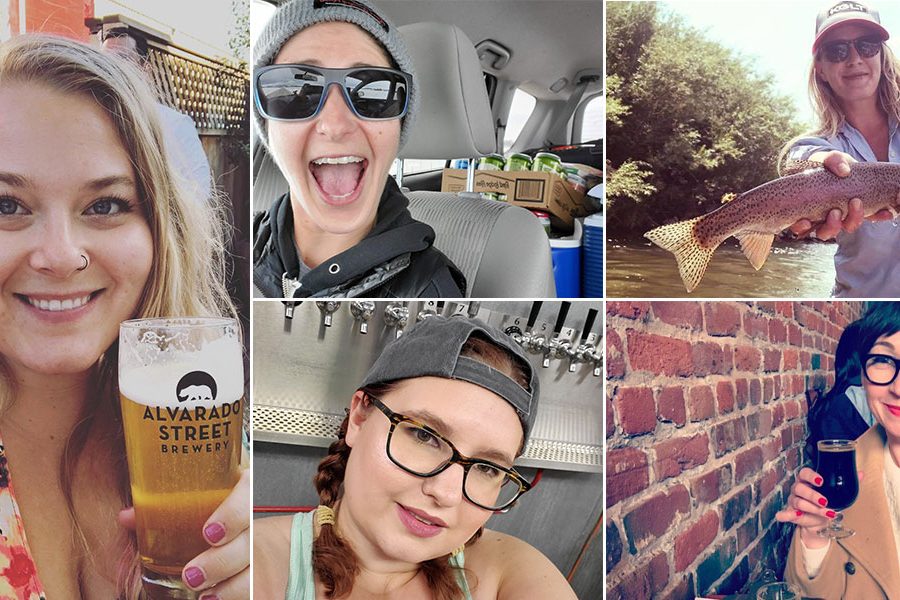

Craft Beer Muses

Craft Beer Muses

When the Brewers Association released the results of their Brewery Operations Benchmarking Survey last year, the data confirmed that there’s still work to do when it comes to diversifying the …

Read More

Craft Beer Muses

These classic Christmas beers from craft breweries pair perfectly whether you’re looking to share a bottle with friends or enjoy as you’re decorating the house for the holidays.

Read More

Craft Beer Muses

Forty years after his first keg, Vermont writer and homebrewer Bill Mares co-founded House of Fermentology, a microbrewery tucked into a one thousand square foot warehouse. His founding partner was …

Read More

Craft Beer Muses

Breweries across the nation want to keep in touch with you via live streams on the Internet. Slake your thirst for social interaction with a web-BEER-nar.

Read MoreCraft Beer Muses shares the stories of America’s most beloved small and independent craft breweries and the people behind them who are working to produce the most unique and flavorful beers in the world.

Share Post